How much does a college degree really cost? This question looms large for many prospective students and their families as they navigate the complex landscape of higher education. With tuition rates soaring and the financial burden of student loans becoming a prevalent concern, understanding the true cost of a college degree extends beyond mere numbers. It encompasses tuition, fees, living expenses, and the potential return on investment after graduation, shaping the decisions of millions on their educational journey.

A deep dive into the costs associated with obtaining a college degree reveals a multifaceted picture. From public to private institutions, each avenue offers a unique financial landscape, with costs influenced by factors such as geographical location and chosen major. Additionally, financial aid and scholarships play a crucial role in alleviating these costs, providing students with opportunities to offset their financial burdens.

As we explore these elements, we will also examine alternative pathways that provide viable options for achieving career goals without the weight of traditional college debt.

Understanding the Costs of a College Degree

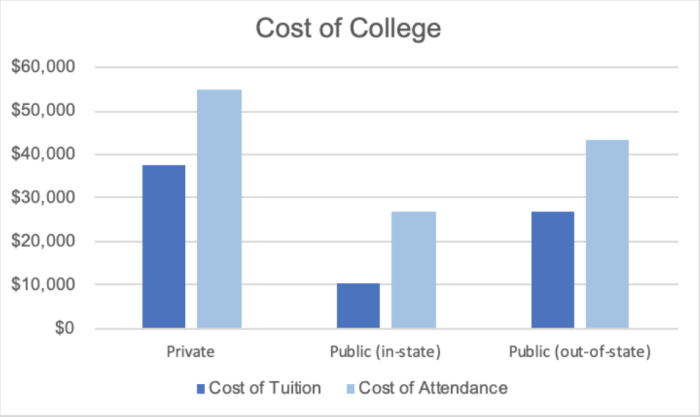

The cost of obtaining a college degree goes beyond just tuition fees. It encompasses various components that can significantly impact a student’s financial situation. Understanding these costs is crucial for prospective students and their families to make informed decisions about their education.The total cost of a college degree includes several factors, each contributing to the overall financial commitment. These costs can vary widely depending on the type of institution—whether it be public, private, or community colleges.

Each type of college has its own fee structure, which can affect the final amount a student will need to budget for their education.

Components of College Costs

To grasp the financial implications of attending college, it is essential to break down the various components that contribute to the total cost of a degree. Below are the primary elements that students must consider:

| Cost Component | Public Colleges | Private Colleges | Community Colleges |

|---|---|---|---|

| Tuition and Fees | $10,000 – $20,000 per year | $30,000 – $50,000 per year | $3,000 – $5,000 per year |

| Books and Supplies | $1,200 – $1,500 per year | $1,500 – $2,000 per year | $500 – $800 per year |

| Living Expenses | $10,000 – $15,000 per year | $15,000 – $20,000 per year | $5,000 – $8,000 per year |

The table above illustrates the variations in costs across different types of institutions. Public colleges generally offer the most economical tuition rates, especially for in-state students, while private colleges can present a much steeper price tag. Community colleges serve as an affordable option, particularly for students looking to complete general education requirements before transferring to a four-year institution.

“Understanding the full spectrum of college costs allows students to plan effectively and avoid unexpected financial burdens.”

When planning your next getaway, finding the perfect accommodation is crucial. For those dreaming of a romantic escape, consider exploring Paris Hotel Bookings that cater to all tastes, ensuring a memorable stay in the City of Light.

In addition to the direct costs listed, there are also indirect costs that students should consider, such as transportation, health insurance, and personal expenses. These can add an additional few thousand dollars to the overall budget, emphasizing the importance of thorough financial planning when pursuing a college degree.

Financial Aid and Scholarships: How Much Does A College Degree Really Cost

Financing a college education can be daunting, but understanding the various financial aid options and scholarships available can significantly alleviate the burden. Financial aid encompasses a broad range of programs designed to help students meet the costs associated with their college education. By tapping into these resources, students can better manage tuition fees, textbooks, and other related expenses.

Types of Financial Aid Available

Numerous financial aid options exist for students, each catering to different needs and circumstances. These options include federal and state grants, work-study programs, and private loans.

- Federal Grants: Programs such as the Pell Grant provide need-based financial assistance that does not require repayment.

- State Grants: Many states offer their own grant programs, which are often based on financial need and residency.

- Work-Study Programs: These programs allow students to work part-time while attending school, helping to cover living expenses and tuition.

- Private Loans: Various banks and financial institutions provide loans that must be repaid with interest, typically requiring a co-signer.

Common Scholarships

Scholarships can significantly reduce the cost of attending college, and they come in various forms. Some are awarded based on academic achievement, while others focus on specific talents or demographics. Several well-known scholarships include:

- National Merit Scholarship: Awarded to high-scoring students on the PSAT/NMSQT.

- Fulbright Scholarship: Offers funding for international educational exchange for students, scholars, and professionals.

- Jack Kent Cooke Foundation Scholarship: Provides financial support to high-achieving students with financial need.

- Local Community Scholarships: Many local organizations and businesses offer scholarships to support students in their region.

Tips for Applying for Financial Aid and Scholarships, How much does a college degree really cost

Successfully navigating the application process for financial aid and scholarships is crucial to maximizing funding opportunities. Adopting effective strategies can enhance a student’s chances of securing necessary support.

- Start Early: Begin researching scholarships and aid programs before the academic year starts to meet deadlines.

- Keep Documents Organized: Maintain all necessary financial documents and academic records in a designated folder for easy access.

- Tailor Applications: Customize each scholarship application to reflect the specific criteria and values of the scholarship.

- Write Strong Essays: Craft compelling personal statements that articulate goals, achievements, and reasons for pursuing the scholarship.

- Seek Recommendations: Obtain letters of recommendation from teachers or mentors who can vouch for your qualifications and character.

Staying proactive and well-organized in the scholarship and financial aid process can open doors to invaluable funding opportunities.

Student Loan Options

Understanding the various student loan options available is crucial for prospective college students. With the rising costs of education, making informed decisions about borrowing is essential. This section elaborates on the types of student loans, their terms, and how to navigate the borrowing process responsibly.

Types of Student Loans

There are two primary categories of student loans: federal loans and private loans. Each type has distinct features and terms that cater to different financial needs.

| Loan Type | Interest Rate | Repayment Options | Credit Check | Loan Limits |

|---|---|---|---|---|

| Federal Student Loans | Fixed, usually lower than private loans | Flexible, including income-driven repayment plans | No | Varies by type (e.g., $5,500 – $20,500 for Direct Loans) |

| Private Student Loans | Variable or fixed, can be higher | Less flexible, often requires a cosigner | Yes | Varies by lender (up to the total cost of attendance) |

Federal student loans are often the first choice for borrowers, as they generally offer lower interest rates and more favorable repayment options. In contrast, private loans may be necessary to cover any remaining education costs but often come with stricter terms and conditions.

Responsible Borrowing Guidelines

When considering student loans, it is important to borrow only what is necessary. Here are some guidelines to help minimize debt:

Assess Your Needs

Evaluate the total cost of attendance, including tuition, housing, and other expenses. Only borrow what is necessary to cover those costs.

Utilize Scholarships and Grants

Before taking out loans, seek scholarships and grants, which do not require repayment.

Understand the Terms

Carefully read the terms of any loan agreement. Be aware of interest rates, repayment schedules, and potential fees.

Plan for Repayment

If you’re venturing to the bustling streets of New York, don’t miss out on the diverse options available. Book a stay at one of the top-rated Hotels In New York City that offer comfort and convenience, making your trip an unforgettable experience.

Create a budget that includes monthly loan payments after graduation. Consider potential income to ensure manageable repayment.

Limit Borrowing for Living Expenses

Consider working part-time or finding cost-effective housing to reduce the need for loans dedicated to living expenses.

> Borrowing responsibly can significantly reduce future financial stress and ensure a safer transition into post-college life.

Return on Investment of a College Degree

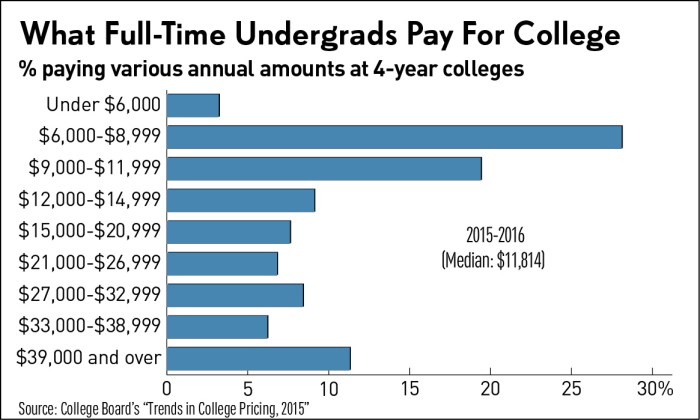

The return on investment (ROI) of a college degree is a crucial consideration for prospective students navigating the complex landscape of higher education. As tuition costs rise, understanding the potential financial benefits becomes increasingly important. A college degree often leads to higher lifetime earnings, but it can also mean accumulating significant debt. Analyzing these factors can help students make informed decisions about their educational paths.Earnings potential varies widely among graduates, influenced by the field of study, job market dynamics, and geographic location.

According to the U.S. Bureau of Labor Statistics, degree holders can earn substantially more than those without a degree. However, this potential must be weighed against the debt incurred during their studies. A detailed examination reveals the stark contrast between post-graduation earnings and the associated costs of obtaining a degree.

Statistics on Post-Graduation Earnings and Debt

A number of studies have quantitatively assessed the financial implications of obtaining a college degree. The following points highlight critical statistics regarding post-graduation earnings compared to debt levels:

- The average annual income for college graduates was approximately $54,000 in 2020, compared to $30,000 for high school graduates.

- Graduates from public four-year institutions typically leave school with an average debt of around $28,000.

- Over a lifetime, a college degree can yield a return of more than $1 million in additional earnings compared to those without one.

This stark difference illustrates the potential benefits of pursuing higher education, yet the accompanying debt presents a significant challenge that new graduates must navigate.

Factors Influencing Return on Investment

Several factors play a pivotal role in determining the ROI of a college degree. These factors include the field of study, employment rates in specific industries, and the overall economic climate. Here are some critical elements affecting ROI:

- Field of Study: Graduates in STEM (Science, Technology, Engineering, and Mathematics) fields tend to have higher starting salaries and lower unemployment rates than those in the humanities or arts.

- Geographic Location: Earnings can vary significantly based on location, with urban areas often offering higher salaries compared to rural regions.

- Institution Reputation: Graduating from a well-regarded institution can enhance job prospects and salary offers.

These factors illustrate the complexities of ROI, emphasizing the need for students to research and assess their chosen fields critically.

Average Salaries and Corresponding Debt Levels

To better understand the financial landscape graduates face, a table outlining the average salaries for various majors and their corresponding debt levels can be insightful. The following table provides a comparative overview:

| Major | Average Salary (Annual) | Average Debt at Graduation |

|---|---|---|

| Engineering | $78,000 | $30,000 |

| Business | $58,000 | $26,000 |

| Education | $45,000 | $25,000 |

| Psychology | $40,000 | $29,000 |

| Fine Arts | $35,000 | $27,000 |

This table highlights the disparities in earnings and debt, reinforcing the notion that while a college degree can lead to higher earnings, the path chosen can significantly influence the return on investment.

The decision to pursue a college degree should be informed by a thorough understanding of the financial implications, including potential earnings and debt.

Alternative Educational Pathways

In the evolving landscape of higher education, traditional college degrees are not the only route to career success. Alternative educational pathways, such as vocational training and online courses, are increasingly gaining recognition for their effectiveness and cost efficiency. These options provide individuals with the necessary skills and certifications to thrive in various industries without the burden of student debt associated with conventional degrees.Vocational training and online courses are structured educational formats that focus on specific skills and competencies.

They cater to a wide range of professions, from healthcare to information technology. One of the most significant advantages of pursuing these alternatives is the reduced cost compared to traditional college degrees. While a four-year degree can cost tens of thousands of dollars, obtaining a certification through vocational training can often be accomplished for a fraction of that amount.

Cost Comparison of Certifications and College Degrees

Understanding the financial implications of these educational pathways is crucial for prospective students. The following points illustrate the cost differences and considerations when choosing between certifications and college degrees:

- Vocational Training: Programs typically range from $1,000 to $10,000 and can be completed in six months to two years.

- Online Courses: Many platforms offer specialized certifications for as low as $100 to $2,000, with flexible schedules that accommodate working adults.

- Traditional College Degree: The average cost of a four-year degree at a public university is approximately $40,000, while private universities can exceed $100,000.

- Return on Investment (ROI): Vocational certifications often lead to immediate employment opportunities with competitive salaries, sometimes matching or exceeding those of graduates with traditional degrees.

The financial benefits are substantial, but the value of non-traditional education also lies in the potential for career advancement. Several successful professionals have achieved remarkable career milestones through vocational training and online certifications.

Successful Career Paths from Non-Traditional Education

Numerous individuals have carved out successful careers without following the conventional educational path. Here are a few notable examples demonstrating the effectiveness of alternative educational pathways:

- Elon Musk, CEO of SpaceX and Tesla, pursued a brief college experience and later focused on self-education in technology and engineering, leading to groundbreaking innovations.

- Rachael Ray, a popular television personality and chef, built her culinary career through hands-on experience, bypassing traditional culinary school.

- Bill Gates, co-founder of Microsoft, dropped out of Harvard University but went on to lead one of the most successful technology companies in history, showcasing the potential of skills over formal education.

- Many skilled tradespeople, such as electricians and plumbers, earn lucrative salaries and enjoy job security through vocational training programs and apprenticeships, demonstrating the demand for skilled labor.

Investing in vocational training and online certifications not only represents a significant cost-saving opportunity but also aligns with the current job market’s demand for specialized skills. As industries evolve, these alternative educational pathways provide a practical solution for those seeking to enhance their career prospects without incurring substantial debt.